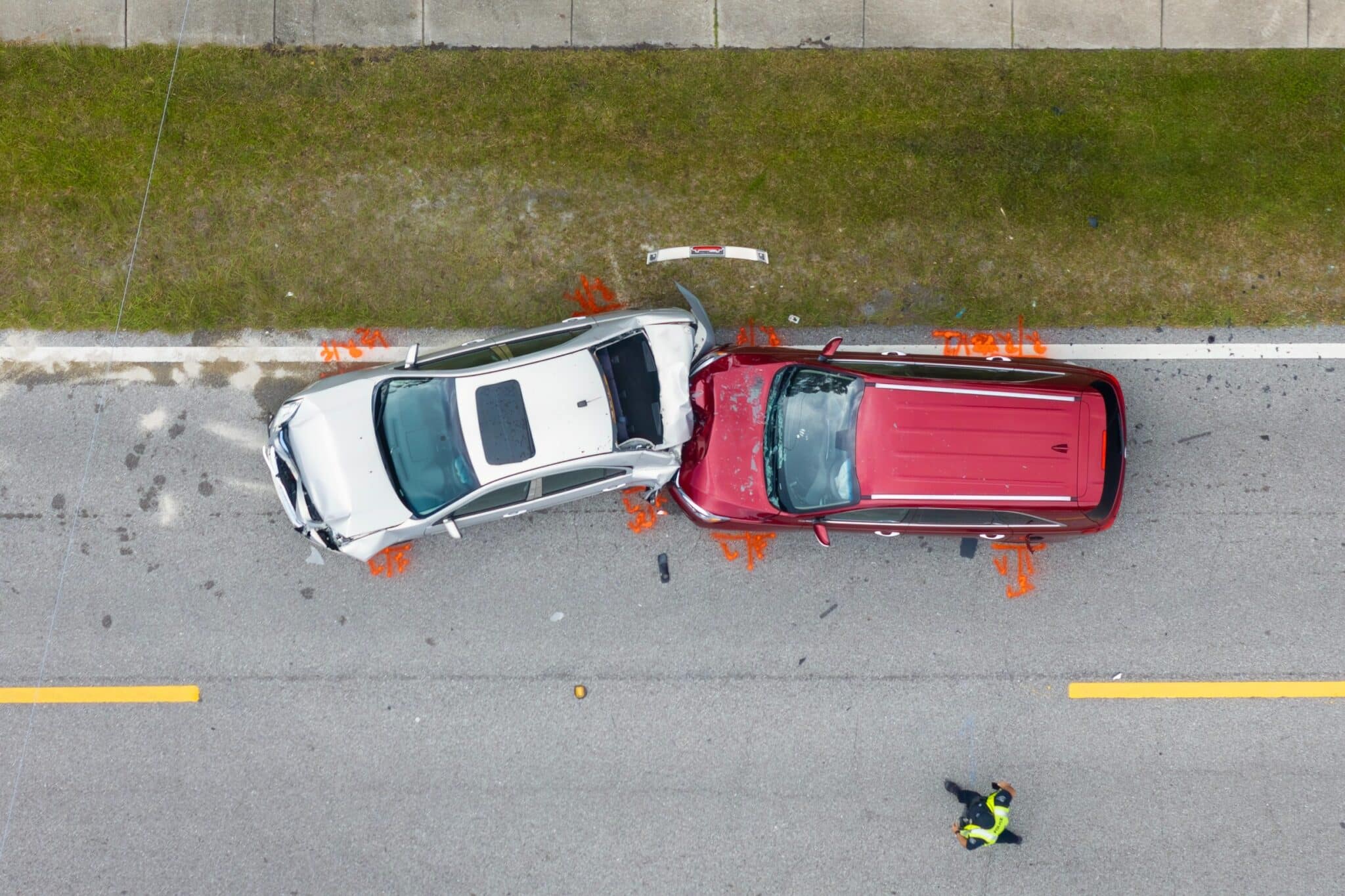

Car Accident? What to do Immediately After – Guest Post

Being involved in a car accident is genuinely one of those experiences that can shake even the calmest person to their core. In those first moments after impact, it’s completely normal to feel disoriented, scared, or unsure of what to do next. Here’s what matters most: the actions you take right after a collision aren’t just important, they can make or break your ability to protect your health, secure fair compensation, and preserve your legal rights. Whether you’ve been rear-ended at a stoplight or involved in a more serious crash, having a clear game plan makes all the difference.

Ensure Safety and Check for Injuries

The very first thing you need to focus on is making sure everyone’s okay. Take a deep breath and do a quick mental check, are you hurt? It’s surprisingly common for adrenaline to mask pain, so don’t automatically assume you’re fine just because nothing hurts yet. Next, turn to your passengers and make sure they’re not injured. If everyone seems alright and it’s safe to do so, get your vehicle out of traffic.

Contact Emergency Services and Law Enforcement

Calling for help should happen quickly, no matter how minor things might seem at first glance. Pick up your phone and call emergency services right away to report what’s happened. Even in what looks like a simple fender bender with no visible injuries, getting police on scene creates an official record that you’ll be grateful for later. Officers will put together an accident report that captures all the essential details, where it happened, what everyone said, and their professional take on the situation.

Exchange Information with Other Drivers

After everyone’s safe and help is on the way, it’s time to swap information with the other drivers involved. You’ll want to collect full names, phone numbers, addresses, driver’s license numbers, and insurance details from everyone behind the wheel in this accident. Take note of each vehicle’s make, model, color, and year too. Here’s where you need to be careful: stay polite and cooperative, but don’t start discussing who’s at fault or saying you’re sorry.

Document the Accident Scene Thoroughly

This step can’t be emphasized enough, documenting everything is absolutely critical for protecting yourself. Pull out your phone and start taking pictures and videos from every angle you can think of. Capture damage to all vehicles involved, both exterior and interior, including any airbags that deployed. Get shots of the entire accident scene: road conditions, any nearby traffic signs or signals, skid marks, scattered debris, and even the weather conditions if relevant.

Seek Medical Attention Promptly

Here’s something that catches a lot of people off guard: feeling fine right after an accident doesn’t mean you actually are fine. Your body’s natural response to trauma can mask some pretty serious injuries for hours or even days. Whiplash, concussions, internal bleeding, and soft tissue damage are notorious for showing up later rather than sooner. That’s why getting checked out by a medical professional should be high on your priority list, even if you feel completely normal.

Notify Your Insurance Company

Getting in touch with your insurance company needs to happen sooner rather than later, since most policies actually require you to report accidents promptly. When you’re on the phone with your insurance rep, stick to the straightforward facts about when and where the accident occurred and the basic details of what happened. Share the information you collected from the other driver and any police report numbers you received. Be truthful and accurate, but here’s the thing, you don’t have to give a recorded statement on the spot. You’re within your rights to speak with an attorney before providing those kinds of detailed statements. When you’re facing a complicated claim or there’s disagreement about who’s at fault, professionals who need to navigate Florida’s insurance requirements often work with a lakeland car accident attorney to ensure their rights are protected throughout the process. Ask about what your policy actually covers, collision, comprehensive, medical payments, uninsured motorist protection, and anything else that might apply to your situation. Find out what the claims process looks like, what the timeline will be, and what documentation they’re going to need from you. Write down the details of every conversation you have with your insurance company: the date, time, who you spoke with, and what was discussed. It’s worth remembering that insurance adjusters, even the ones from your own company, are trained to keep payouts as low as possible. Be cautious about jumping on quick settlement offers before you truly understand the full scope of your injuries and damages.

Conclusion

What you do in those first crucial moments and hours after an accident can shape everything that follows. By putting safety first, documenting everything you possibly can, getting medical attention without delay, and being thoughtful about your communications, you’re setting yourself up to recover fully, both physically and financially. The reality is that the stress and confusion of an accident can make it hard to think clearly in the moment. That’s exactly why understanding these steps ahead of time is so valuable.

Recent Comments